Shift-share analysis is a popular and generally simple longitudinal statistical method used to assist in determining the local or regional economic make-up, and how that make-up changes over time when compared to a larger, and encompassing, economy. While shift-share analysis can highlight industrial strengths and weaknesses within an economy and point to certain comparative advantages or disadvantages, it does not provide any detail as to why certain industries would expand or contract at rates different than the larger economy. Local knowledge and further investigation is required to determine why expansion contraction occurs. According to the Chicago Metropolitan Agency for Planning (CMAP), “Shift-share estimates how much employment change in the region is likely due to changes in the national economy and how much change is due to industry specific trends.”

Data is an important consideration when conducting shift-share analysis. Both the US Census Bureau (via the County Business Patterns dataset) and the US Bureau of Economic Analysis (derived from the Bureau of Labor Statistics) provide appropriate datasets. For a detailed breakdown on the differences between the two datasets, please visit the BEA’s FAQ.

Shift-share analysis is conducted by comparing two points in time, and as a result the analysis can change dramatically based on the points in time chosen. For example, the United States recently suffered one of the worst recessions in its history, and the number of jobs at the onset of the recession was much higher than at its end. Another data consideration is the level of industrial specification. Industrial data at the two-digit NAICS code level is widely available for most industries at the county level. However, once the data is disaggregated to the three-digit or more NAICS code level, privacy concerns become reality and data suppression is the result.

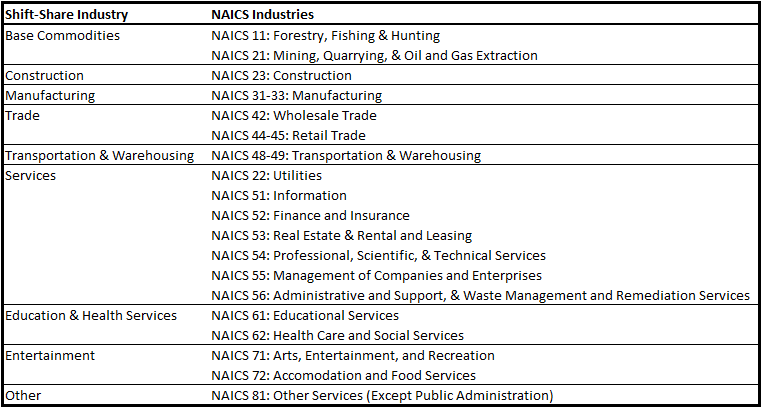

The County Business Patterns (CBP) dataset was utilized to conduct a shift-share analysis for the Mid-America Freight Coalition region. It should be noted that while the CBP reports data at the two-digit NAICS code level, these industries were aggregated up to reduce the number of industries analyzed. Table 1 below illustrates a cross-walk for the aggregation of industries.

Table 1: Shift-Share Industry to NAICS Industry Crosswalk Table

Shift-share analysis can be broken down into three separate sources of change in employment: the National Growth Component (NGC); the Industrial Mix Component (IMC); and the Local Share Component (LSC) or Competitive Share Component.

National Growth Component (NGC)

Part 4 of Understanding Economic Change in Your Community describes the NGC as the “local job growth that is attributed to national economic growth. Specifically, if the nation is experiencing employment growth, it is reasonable to expect that this growth will positively influence your area. This component describes the change that would be expected due to the fact that the local area is part of a dynamic national economy.”

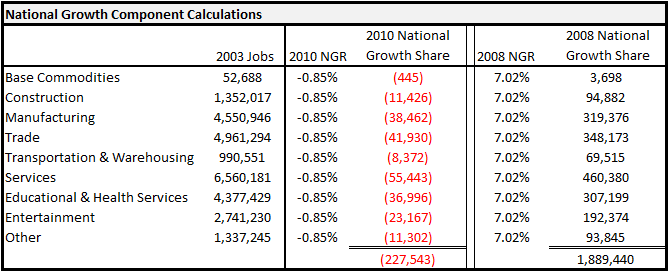

To calculate the NGC, multiply each industry’s employment from the base year of analysis, here 2003, by the nation’s overall employment growth rate for the same time period, and then sum the results from each industry. The overall employment growth rate between 2003 and 2008 was 7.02 percent, and between 2003 and 2010 was -0.85 percent.

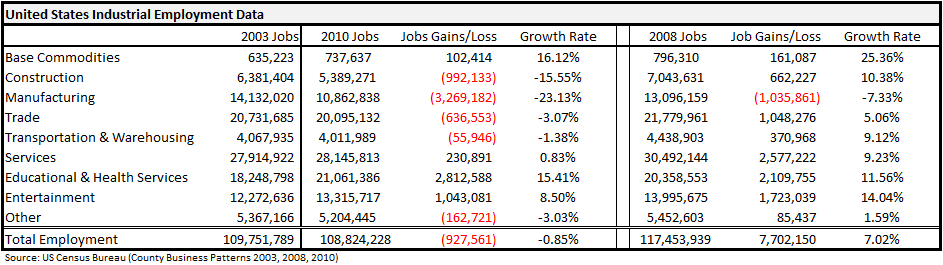

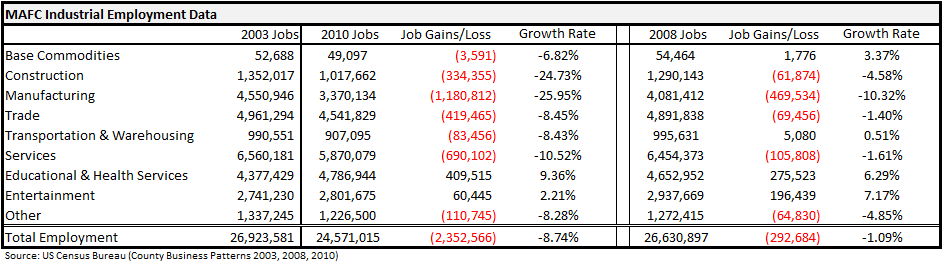

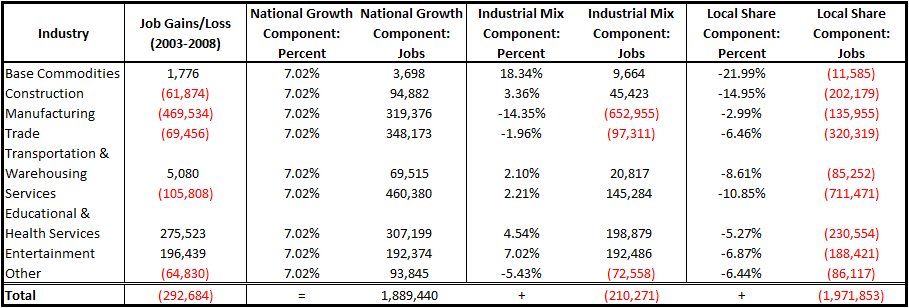

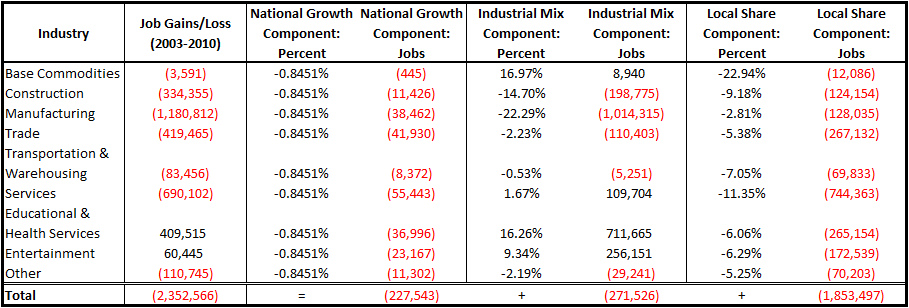

As discussed earlier, the Great Recession officially began in December of 2007 and officially ended in June of 2009, so employment data for both 2008 and 2010 will be analyzed. Table 2 shows the national employment growth rates for the two time periods, while Table 3 shows the employment growth rates for the MAFC region. Table 4 shows the NGC for the MAFC region. Had the MAFC’s economy mirrored that of the national economy, we could have expected the MAFC economy to lose about 225,000 jobs between 2003 and 2010, and conversely gain almost two million jobs between 2003 and 2008. Instead, the region experienced jobs losses of almost 2.5 million and 300,000 respectively.

Table 2: US Industrial Employment Data

Table 3: MAFC Industrial Employment Data

Table 4: National Growth Component Calculations

Industrial Mix Component (IMC)

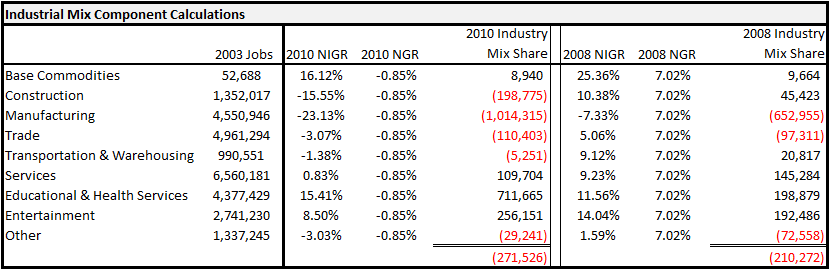

As discussed in Understanding Shift Share, the industrial mix component “represents the share of regional industry growth explained by the growth of the specific industry at the national level.” The IMC also helps to determine if the local/regional economy is weighted toward industries that are expanding or contracting faster than the national average. To calculate the IMC, multiply each local/regional industry’s employment from the base year by the difference between the industry’s growth rate at the national level (NIGR) and the overall national growth rate (NGR). Both were calculated in Table 5 representing the results for the MAFC. The negative industrial mix component means the regional economy is weighted towards those industries losing employment, and therefore the local economy contracted more than that of the U.S. economy.

Table 5: Industrial Mix Component Calculations

Local Share Component (LSC)

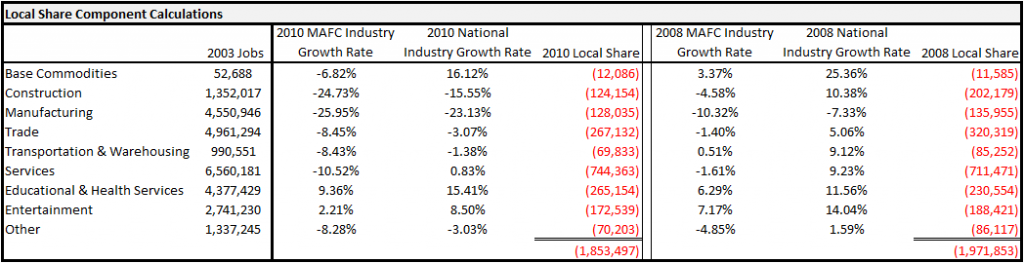

The local share component is the employment change in a local/regional economy that the national and industrial components cannot account for, and usually this is attributed to some unique characteristics of the region that lead to a competitive advantage. A positive local share for an industry can be understood as that local industry being more competitive than the national average. The LSC is calculated by taking the regional growth rate for a particular industry and subtracting the national growth rate for the same industry and then multiplying the difference by the regional employment in the base year. According to Table 6, the MAFC region had a negative local share component for every industry.

Table 6: Local Share Component Calculations

Tables 7 and 8 show the MAFC shift-share analysis for 2008 and 2010 with the National Growth Component, Industrial Mix Component, and Local Share Component side by side.