A port of entry (POE) is a designated area where a customs officer is authorized to accept entries of merchandise, collect duties, and enforce customs and navigation laws (19 C.F.R. § 101.1). POEs act as a gateway for goods and people to flow in and out of the United States, which makes it a valuable economic development opportunity. POE status carries various opportunities to encourage local economic activity. One of the largest economic opportunities is establishing foreign-trade zones (FTZs).

FTZs come in two forms: general purpose zones (GPZ) and subzones. General purpose zones may have multiple companies using the site and are usually located at a POE or an industrial park. Subzones are approved for a single companies use when a general purpose zone cannot accommodate the user. Subzones are typically manufacturing facilities and are located at company manufacturing facilities. Each POE is entitled to at least one adjacent foreign-trade zone (FTZ). Adjacency for a GPZ is defined as a location within 60 miles or 90 minutes of driving time by US law. Adjacency for a subzone is reliant on the subzone meeting supervision requirements from Customs and Border Protection (15 C.F.R. § 400.2).

FTZs confer tariff benefits on the user and exist to encourage foreign commerce (15 C.F.R. § 400.1). FTZs increase the number of options available to users when applying tariffs to imports. One of the largest benefits to FTZ users is the ability to choose when to pay a tariff on a good. Some products have an inverted tariff structure where components have a higher tariff than the finished product. Inverted tariffs incentivize the use of American workers to assemble products. Some of the benefits of FTZs for companies are:

- Zone users can choose to pay a tariff on the final product when it exits a FTZ or pay tariffs on the inputs.

- No duty is due if a good is re-exported out of the FTZ, scrapped, or destroyed in a FTZ.

- Zones eliminate the need to apply for duty drawback when a good is imported and then re-exported.

- Products can be transferred zone-to-zone without paying a duty.

- FTZs allow the user to file a weekly entry reports and pay a single processing fee rather than individual fees.

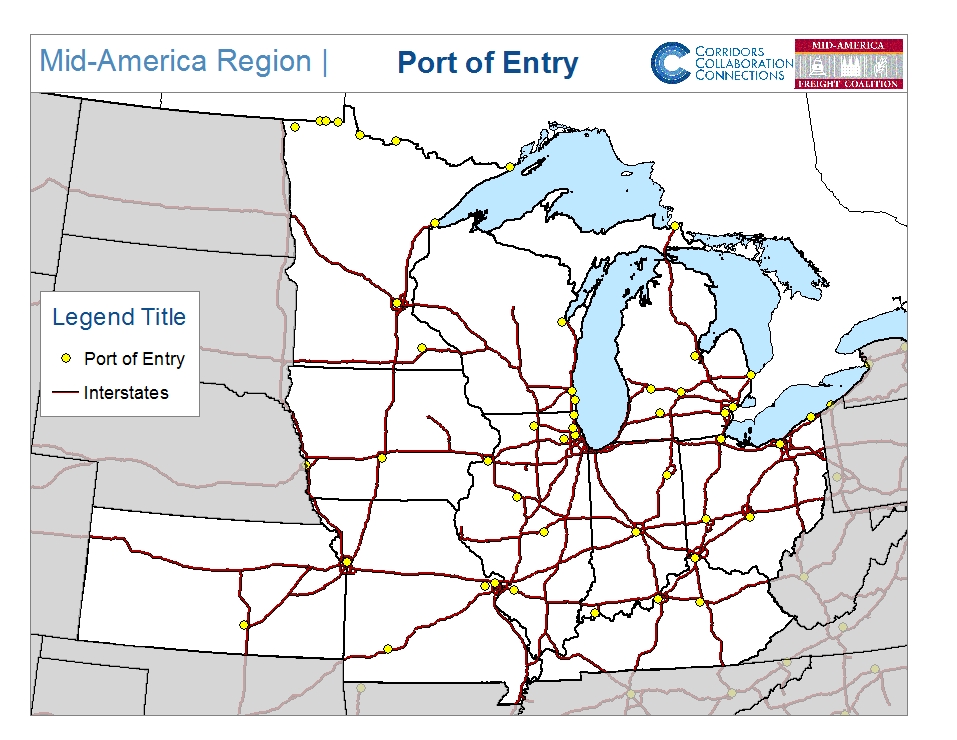

Figure 1 shows the locations of ports of entry in the MAFC. The majority of the ports of entry in the MAFC are located at airports. In addition to airport locations, the MAFC has border crossings in Minnesota and Michigan that qualify as ports of entry. The opportunities for establishing foreign trade zones will be discussed elsewhere in the RFS, but the number and distribution of MAFC ports of entry make foreign trade zones a substantial economic development opportunity.

Figure 1: Ports of Entry in the MAFC

Source: Ports of Entry, 2012