Freight transportation is one of the most important factors affecting globalization: global production processes rely on the timely, efficient, and cost-effective movement of goods. The underlying economic success of globalization lies in comparative advantages that certain countries hold relative to others. For instance, the relatively low cost of labor in countries such as China and India have caused companies to move labor-intensive production processes overseas. While other portions of the production process may occur in the United States due to the skill of the US workforce and the high capital-to-labor ratio. The global economy hosts a myriad of close connections between production processes that occur domestically and abroad or domestic production processes that use foreign intermediate goods. Companies across the world work together to produce finished products that are themselves transported throughout the world for consumption. Transportation is a significant barrier or enabler of globalization because it either allows for or blocks the gains possible for producing goods throughout the world. For instance, if transportation costs are high enough to offset the labor advantages of China, companies may have an incentive to move to a country closer to their final market. On the other hand, lower transportation costs increase the feasible distance that companies can look for inputs, intermediate goods, or source production.

The story of globalization is constantly changing; companies are innovating to maximize the gains possible from leveraging comparative advantages between different parts of the world. Freight movers, US DOT, state DOTs, and local governments must in turn innovate to realize the benefits of a connected world. The first step in understanding globalization from a freight perspective is to understand the flows and the modes of international trade. The geographic location of the MAFC affects its trade relationships within the United States as well as its relationship to the rest of the world. The MAFC has a variety of methods to move freight internationally. One primary method is trucking freight from Mexico and Canada into and out of the region. The MAFC has border crossings in Minnesota and Michigan that support freight flows from the United States to Canada. Similarly, the MAFC relies on its network of railroads, maritime transport, and pipelines to move bulk goods from the Midwest to Canada. Also, as shown in the overview of the freight system, the MAFC has a pervasive network of airports to support high value air cargo movements.

Lastly, the MAFC uses its connections to the rest of the United States to efficiently move freight out of the region and to international markets. The top non-MAFC destination for freight originating in the MAFC is the Los Angeles FAF zone. While, Los Angeles is a large metropolitan area with an equally large demand for goods, the Port of Long Beach is a major driver of MAFC freight headed to and from the Los Angeles FAF zone. The MAFC’s geographic location affects the modes of transportation used to move freight internationally, but the MAFC’s access to all major modes of transportation allows for a robust set of global imports and exports.

Imports

The MAFC imports a variety of goods for consumption and inputs to domestic production processes. Imports are a necessary part of globalization and allow the United States to specialize in goods where it has a comparative advantage producing. Both the import and export section will primarily use USA Trade Online, which is collected largely for trade-related regulations. The data used is measured in value and compared over a 2008-2012 timeframe. USA trade online includes data that is pre-2008 for exports, but is unavailable for imports.

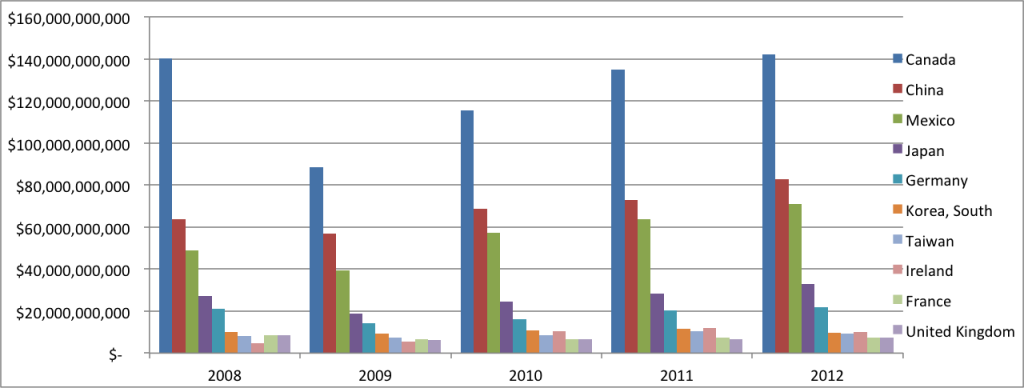

Figure 1 displays the MAFCs top trading partners based on the value of goods imported into the US from 2008-2012. The top 10 trading partners were chosen by the average value of goods imported into the MAFC from 2008-2012. The yearly ordering of countries is defined by the country with the greatest average imports into the MAFC from 2008-2012; therefore the yearly order of the countries may not be largest to smallest. The MAFCs top 10 trading partners based on value of imports has been very consistent over the past five years. With the exception of Italy replacing Ireland in 2008, the top 10 import trading partners have not changed in the past five years. Canada dwarfs the rest of the countries, accounting for between 29-34 percent of yearly MAFC imports from 2008-2012. The other two import powerhouses, China and Mexico, have steadily increasing in the size over the five-year time horizon with the exception of 2009. Canada, China, and Mexico collectively comprise between 60-62 percent of the value of all goods imported into the MAFC. The top 10 importing partners combine to account for between 82-83 percent of the total value of goods in 2008-2012. Table 1 displays the yearly value of imports to each of the top 10 countries in shown Figure 1.

Going beyond the top 10 trading partners by imports and looking at the magnitude of flows from countries ranked 11-20 shows the MAFC’s concentrated import partners. Compared to the top 10 trading partners that make up between 82-83 percent of yearly total imports, import partners 11-20 comprise between 8-9 percent of value yearly. For any given year, the top twenty import trading partners account for between 91-92 percent of value imported into the MAFC and only 9 percent of the countries that the MAFC had imports valued at greater than zero.

Figure 1: Top 10 MAFC Trading Partners by Imported Value for 2008-2012

Source: USA Trade Online. US Census.

Table 1: Top 10 MAFC Trading Partners by Imported Value for 2008-2012

| Country | 2008 ($ millions) | 2009 ($ millions) | 2010 ($ millions) | 2011 ($ millions) | 2012 ($ millions) |

| Canada | $140,163 | $88,590 | $115,664 | $134,987 | $142,309 |

| China | $63,691 | $56,711 | $68,634 | $72,870 | $82,804 |

| Mexico | $48,852 | $39,204 | $57,259 | $63,831 | $70,884 |

| Japan | $27,326 | $18,895 | $24,689 | $28,169 | $32,753 |

| Germany | $21,004 | $14,436 | $16,306 | $20,353 | $21,686 |

| Korea, South | $9,979 | $9,228 | $10,838 | $11,395 | $9,593 |

| Taiwan | $8,148 | $7,208 | $8,568 | $10,316 | $9,125 |

| Ireland | $4,906 | $5,675 | $10,519 | $11,899 | $10,096 |

| France | $8,600 | $6,567 | $6,788 | $7,494 | $7,388 |

| United Kingdom | $8,597 | $6,130 | $6,517 | $6,797 | $7,538 |

| World | $412,868 | $306,880 | $392,023 | $446,367 | $477,307 |

| Top 10 Percentage | 82.7% | 82.3% | 83.1% | 82.5% | 82.6% |

Source: USA Trade Online. US Census.

The dataset used to shed light on top MAFC trading partners only included data for 2008-2012. As such, the Great Recession is right in the middle of the time series and inserts a level of uncertainty for future ranking of trade partners. The flows of freight between the MAFC and import trading partners could be affected in a number of ways depending on the Great Recession’s effect on the economic structure of the MAFC and global economy. On one hand, it is possible that the Great Recession only decreased demand temporarily and the relationship between countries on an industrial level remained intact.

On the other hand, structural changes may have occurred that altered the relationship between industrial trade patterns and thus changed the trading partners of the MAFC and its industries. Table 2 looks at each of the top 10 MAFC import partners by value and analyzes the yearly percentage of total imports for each country. Table 2 includes each year in the time series and shows the relative importance of each country by imports into the MAFC. Column 2 displays the yearly percentage point changes for each of the top 10 import trading partners. The first bar in each Sparkline is the difference between 2008 and 2009, an increase means that the country, as a percent of total, became a larger import partner for the MAFC in 2009 than it was in 2008 and vice versa for negative bars. Table 2 goes beyond 2009 being the lowest point in GDP for the United States during the Great Recession and the subsequent drop in MAFC imports for the majority of trading partners and looks at the relative importance of each country year-to-year. The Great Recession disproportionally affected countries such as Germany, France, and Canada compared to China, Mexico, and Ireland. The global economy is in a constant state of shift, but looking at the data before and after the Great Recession, it appears that the importance of selected countries changed during the data series available.

Table 2: Yearly Variations in Top 10 Importing Countries Percentage of Total MAFC Imports 2008-2012

| Yearly Changes in Percent of Total Imports | 2008 | 2009 | 2010 | 2011 | 2012 | Change from 2008-2012 | |

| Canada | Canada_Imports.png | 33.95% | 28.87% | 29.50% | 30.24% | 29.81% | -4.13% |

| China | China_Imports.png | 15.43% | 18.48% | 17.51% | 16.33% | 17.35% | 1.92% |

| Mexico | Mexico_Imports.png | 11.83% | 12.77% | 14.61% | 14.30% | 14.85% | 3.02% |

| Japan | Japan_Imports.png | 6.62% | 6.16% | 6.30% | 6.31% | 6.86% | 0.24% |

| Germany | Germany_Imports.png | 5.09% | 4.70% | 4.16% | 4.56% | 4.54% | -0.54% |

| Korea, South | South_Korea_Imports.png | 2.42% | 3.01% | 2.76% | 2.55% | 2.01% | -0.41% |

| Taiwan | Taiwan_Imports.png | 1.97% | 2.35% | 2.19% | 2.31% | 1.91% | -0.06% |

| Ireland | Ireland.png | 1.19% | 1.85% | 2.68% | 2.67% | 2.12% | 0.93% |

| France | France_Imports.png | 2.08% | 2.14% | 1.73% | 1.68% | 1.55% | -0.54% |

| United Kingdom | UK_Imports.png | 2.08% | 2.00% | 1.66% | 1.52% | 1.58% | -0.50% |

Source: USA Trade Online. US Census.

An additional look at top trade partners by the value of imports are what are classified as “expanding import partners,” i.e., largest percentage increases are based on an average of annual growth rates over the time series. To identify expanding import partners, we first took only trading partners whose averaged imports into the MAFC where valued at greater than .1 percent of the total average imports into the region from 2008-2012. The resulting list of countries included 43 out of the 235 possible trading partners present in the dataset. Next, we calculated the average of annual growth rates in imports into the MAFC to find those countries that had consistent growth rather than large differences between two individual years. Table 3 displays the top expanding import partners; the listed countries are largely different from those listed in Figure 1. The relative rank of each country is shown to provide a context for the importance of each expanding import partner. For instance, Switzerland, Vietnam, and Denmark have large increases in average annual growth of imports into the United States, while being in the top 20 trading partners. The combination of with large annual average growth and relatively high trade rankings have increased the importance of countries such as Switzerland, Vietnam, and Denmark and if the trend continues it is possible that they may break into the top 10 partners.

Table 3: Top Expanding Import Partners from 2008-2012

| Rank | Country | Average Annual Growth Rate 2008-2012 | Rank based on Average Annual Value |

| 1 | Trinidad and Tobago | 33.7% | 31 |

| 2 | Switzerland | 24.9% | 14 |

| 3 | Ireland | 24.7% | 8 |

| 4 | Chile | 22.5% | 43 |

| 5 | Turkey | 20.9% | 32 |

| 6 | Costa Rica | 19.9% | 39 |

| 7 | Poland | 19.3% | 33 |

| 8 | Czech Republic | 18.3% | 35 |

| 9 | Bangladesh | 18.2% | 44 |

| 10 | New Zealand | 17.6% | 37 |

| 11 | Hungary | 17.6% | 40 |

| 12 | Vietnam | 17.3% | 18 |

| 13 | Denmark | 15.7% | 19 |

| 14 | Mexico | 12.2% | 3 |

| 15 | Spain | 10.4% | 26 |

Source: USA Trade Online. US Census.

Furthermore, the data shows yearly increases and decreases in the concentration of value in a few countries. We use a Gini coefficient to find the relative concentration of the value of goods imported into the MAFC. The Gini coefficient goes from zero to one, with zero being a distribution that is completely equal between all countries to one where all imports are concentrated in one country. The MAFC has a yearly Gini coefficient from 0.9455-0.9474. The MAFC shows great inequality based on the value of imports from countries around the world in general and the coefficients have only gotten slightly more equal over the time series. This is not to say that a Gini coefficient of close to one is bad; it does show the importance of a few countries to the MAFC and allow the infrastructure implications to flow from that concentration.

Table 4 shows the top 15 commodities that the MAFC imports by value based on the North American Industry Classification System (NAICS) at a 3-digit level. The top 15 commodities comprise an average of 93.1 percent of the total value of goods imported into the MAFC. As a frame of reference, there are 33 unique 3-digit NAICS codes in the USA Trade Online dataset. Therefore, 45.5 percent of commodities account for 93.1 percent of value imported by the MAFC. Similarly, comparing the MAFC’s Gini coefficient for commodities to that of international import partners, commodities are between 24-29 percent more equal than international import partners. The commodity Gini coefficient fluctuates between 0.6675-0.7203 from 2008-2012. The MAFC heavily imports in the manufacturing NAICS codes. Based on a two-digit aggregation of NAICS codes, the manufacturing industry (33) comprises on average 54.7 percent of imports from 2008-2012.

Table 4: Top 15 Imported Three Digit NAICS Commodities imported into the MAFC by Value

| Rank | Three Digit NAICS Code | NAICS Explanation | Average Annual Value 2008-2012 ($millions) | Percent of Total Imports |

| 1 | 336 | Transportation Equipment | $77,871 | 21.7% |

| 2 | 334 | Computer & Electronic Products | $46,112 | 12.9% |

| 3 | 211 | Oil & Gas | $39,121 | 10.9% |

| 4 | 325 | Chemicals | $36,895 | 10.3% |

| 5 | 333 | Machinery, Except Electrical | $32,326 | 9.0% |

| 6 | 335 | Electrical Equipment, Appliances & Components | $16,608 | 4.6% |

| 7 | 331 | Primary Metal Mfg. | $14,136 | 3.9% |

| 8 | 332 | Fabricated Metal Products, Nesoi | $12,615 | 3.5% |

| 9 | 339 | Miscellaneous Manufactured Commodities | $12,440 | 3.5% |

| 10 | 980 | Goods Returned (exports For Canada Only) | $10,522 | 2.9% |

| 11 | 315 | Apparel & Accessories | $10,094 | 2.8% |

| 12 | 326 | Plastics & Rubber Products | $8,102 | 2.3% |

| 13 | 311 | Food & Kindred Products | $6,859 | 1.9% |

| 14 | 322 | Paper | $5,102 | 1.4% |

| 15 | 316 | Leather & Allied Products | $4,931 | 1.4% |

Source: USA Trade Online. US Census.

The take-away point of this section is the relative size of trading partners the MAFC receives goods from helps frame the discussion regarding the freight infrastructure to support these flows. For Instance, the Canada and Mexico account for between 44-46 percent of yearly import flows and rely heavily on trucking, whereas China is between 15- 18 percent of imports and likely comes into the United States via marine transport and is distributed by rail and truck using East-West corridors rather than North-South.

Exports

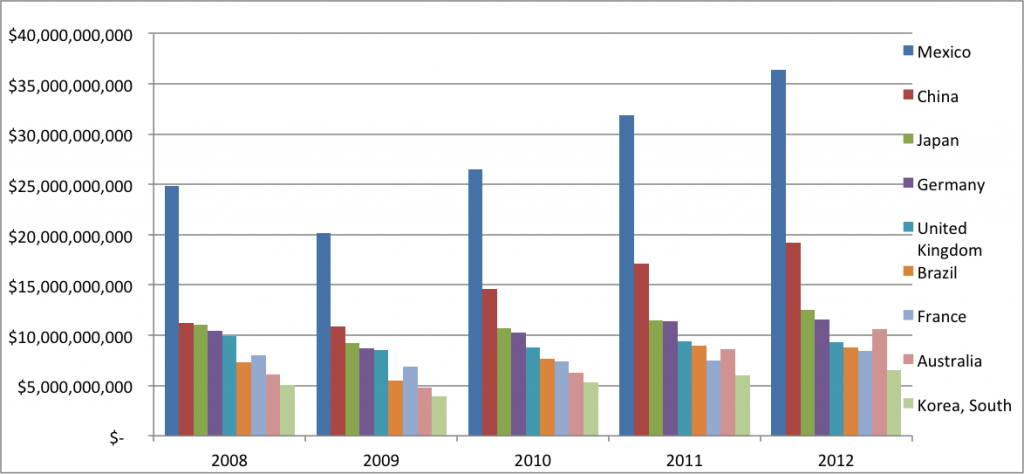

Exports are the other side of the trading partner equation and are looked upon more favorably than imports for their job creation benefits, though both are crucial to an efficient use of resources. Figure 2 displays the top 10 export partners absent Canada. The MAFC exports between three and four times the value of the second largest exporting partner to Canada and as such makes the Figure 2 almost unusable. Therefore, Table 5 accompanies Figure 2 to show the MAFC’s exports to Canada relative to the other countries in the top 10. Similarly, Table 5 also displays the total MAFC exports to the world and calculates the top 10 exporting partner’s portion of total exports.

As with imports, the MAFC exports heavily to a few countries rather than a more even distribution around the world. In total, during 2008-2012 the MAFC exported between 34-37 percent of all exports to Canada. Furthermore, the top 10 trading partners based on exports accounted for between 72-74 percent of total exports from 2008-2012. Extending the list of top trade partners by exports, the top 20 countries account for between 85-86 percent of all exports originating in the MAFC from 2008-2012. Therefore, of the 238 countries that the MAFC had trade greater than zero from 2008-2012, just 20 or 8.4 percent of countries account for 85-86 percent of exports.

Figure 2: Top 10 MAFC Trading Partners by Exported Value for 2008-2012

Source: USA Trade Online. US Census.

Table 5: Top 10 MAFC Trading Partners by Exported Value 2008-2012

| Country | 2008 ($ millions) | 2009 ($ millions) | 2010 ($ millions) | 2011 ($ millions) | 2012 ($ millions) |

| Canada | $98,553 | $72,828 | $92,358 | $104,064 | $108,129 |

| Mexico | $24,819 | $20,191 | $26,487 | $31,916 | $36,393 |

| Japan | $11,051 | $9,243 | $10,715 | $11,489 | $12,513 |

| China | $11,231 | $10,839 | $14,595 | $17,115 | $19,214 |

| United Kingdom | $9,920 | $8,505 | $8,748 | $9,419 | $9,313 |

| Germany | $10,430 | $8,694 | $10,232 | $11,380 | $11,591 |

| France | $8,043 | $6,904 | $7,361 | $7,452 | $8,431 |

| Australia | $6,091 | $4,805 | $6,230 | $8,621 | $10,599 |

| Brazil | $7,327 | $5,525 | $7,682 | $8,973 | $8,756 |

| Netherlands | $5,794 | $4,234 | $4,636 | $5,313 | $5,230 |

| World | $267,311 | $208,681 | $256,812 | $296,041 | $313,775 |

| Top 10 Percentage | 72.3% | 72.7% | 73.6% | 72.9% | 73.4% |

Source: USA Trade Online. US Census.

Similar to imports, exports also show a decreasing then increasing trend centered on the 2009 trough of the Great Recession. Table 6 looks at the yearly percentage of MAFC exports of each of the top 10 export partners to show how different countries where affected by the recession. Some countries saw their portion of MAFC exports increase while others saw a decrease in their overall portion. In the years post-recession, the MAFC may see a reversion back to pre-recession levels of trade with countries like Canada, Germany, and the Netherlands. Conversely, the role of countries such as Mexico, Australia, and China may continue to expand. In addition, the Sparkline in the second column displays the yearly changes in a percentage point format for each country. The first bar in each Sparkline is the change from 2007 to 2008.

Table 6: Yearly Variations in Top 10 Exporting Countries Percentage of Total MAFC Exports 2008-2012

Source: USA Trade Online. US Census.

Table 7 displays the top 15 “emerging export partners” for the MAFC from 2008-2012. We identified emerging export partners in the same way the emerging import partners. First, to qualify for the list, a country must have greater than .1 percent of total MAFC exports destined for their country. Next, we calculated the average of the annual growth rate of exports moving to each country and finally ranked each by their growth rate from 2008-2012. The emerging export partners are largely a new list compared to the top trading partners. The only duplicates are Australia, China, and Mexico, who all had increases in their share of MAFC exports each year from 2008-2012. In addition, the fourth column displays the average annual value for each emerging export country to give a context about the importance of each country in terms of MAFC exports. The countries with the largest average of annual growth rates are largely outside of the top 20 countries. Intuitively it makes sense that countries outside of the top 20 would be in a position to have higher growth rates, because a small absolute change in a top 20 country is a smaller percentage change than the same absolute change in a country not in the top 20. That being said, a truly emerging export partner country can continue its above average annual growth in value over time and improve its ranking. On the other hand, for China and Mexico made the emerging export partner list because they had a large absolute change in receiving MAFC exports.

We calculate a Gini coefficient for the MAFC’s export by value and come up with a more equal distribution of exports compared to imports. The Gini coefficient for exports is in the 0.9196-0.9247 range compared to the 0.9455-0.9474 range for imports. Both numbers are very high and show the MAFC’s concentrated trade with a few countries. Interestingly, the MAFC’s export Gini coefficient is going up (becoming less equal) whereas the import Gini coefficient is going down (becoming more equal). The changes in the Gini coefficients are small, 0.1 percent for imports and 0.5 percent for exports over the 2008-2012 time series.

Table 7: Emerging Export Partners 2008-2012

| Rank | Country | Average of Annual Growth Rates 2008-2012 | Rank by Average Annual Value |

| 1 | Greece | 97.8% | 50 |

| 2 | Afghanistan | 76.2% | 62 |

| 3 | Ukraine | 34.7% | 55 |

| 4 | Nigeria | 27.3% | 48 |

| 5 | Peru | 19.2% | 37 |

| 6 | Russia | 18.8% | 26 |

| 7 | Chile | 17.8% | 21 |

| 8 | Australia | 17.5% | 8 |

| 9 | Ecuador | 16.3% | 57 |

| 10 | China | 15.2% | 4 |

| 11 | Vietnam | 15.0% | 46 |

| 12 | Saudi Arabia | 14.6% | 17 |

| 13 | Indonesia | 12.0% | 35 |

| 14 | Mexico | 11.8% | 2 |

| 15 | Panama | 11.3% | 56 |

Source: USA Trade Online. US Census.

Table 8 displays the top exported commodities for the MAFC during 2008-2012 and the percent of the total exports that each commodity comprises. In total, the top 15 exported commodities comprise an average of 93.6 percent of the total value exported by the MAFC from 2008-2012, which is comparable to imports. Conversely, the Gini coefficient for exported commodities is between 0.7196-0.7207 compared to imports, which ranged from 0.6675-0.7203. Imports have become more concentrated and exports less concentrated from 2008-2012. However, both imports and exports have increases and decreases in their Gini Coefficients. So, it is unclear whether the MAFC is moving towards a more diverse distribution of imported and exported commodities or one that is simply staying the same with small yearly fluctuations. On a two-digit NAICS code basis, the MAFC exports primarily goods from the manufacturing industry. The manufacturing industry accounts for 65.7 percent of the yearly value exported by the MAFC.

Table 8: Top Exported Commodities for the MAFC 2008-2012

| Rank | Three Digit NAICS Code | NAICS Explanation | Average Annual Value 2008-2012 ($millions) | Percent of Total Exports |

| 1 | 336 | Transportation Equipment | $268,524 | 25.1% |

| 2 | 333 | Machinery, Except Electrical | $67,377 | 17.0% |

| 3 | 325 | Chemicals | $45,683 | 12.9% |

| 4 | 334 | Computer & Electronic Products | $34,662 | 8.5% |

| 5 | 311 | Food & Kindred Products | $22,725 | 5.2% |

| 6 | 335 | Electrical Equipment, Appliances & Components | $13,951 | 3.8% |

| 7 | 331 | Primary Metal Mfg. | $10,330 | 3.8% |

| 8 | 332 | Fabricated Metal Products | $10,330 | 3.8% |

| 9 | 339 | Miscellaneous Manufactured Commodities | $10,077 | 3.1% |

| 10 | 111 | Agricultural Products | $8,377 | 2.7% |

| 11 | 326 | Plastics & Rubber Products | $7,222 | 2.6% |

| 12 | 322 | Paper | $7,018 | 1.6% |

| 13 | 910 | Waste And Scrap | $4,189 | 1.2% |

| 14 | 327 | Nonmetallic Mineral Products | $3,239 | 1.2% |

| 15 | 324 | Petroleum & Coal Products | $3,141 | 1.1% |

Source: USA Trade Online. US Census.

Interactive Map

To allow officials and policy analysts to look at both individual state data and MAFC data, we have created interactive maps detailing the export partners for the MAFC states. The data is presented in absolute numbers and yearly percent changes. Additionally, the data presented goes from 2002-2012 and the maps include a time slider to compare and contrast yearly export flows to each country. The primary focus of the raw data is to show the largest exporting partners for the MAFC on any given year and changes throughout the time series. The change data speaks to the emerging partners and shows the relative size and direction of the change in export flows.

Modal Distribution

The USA Trade Online dataset does not include the method of transportation. Therefore, to supplement the USA Trade Online dataset we use FAF 3.4 to find the proportion of imports and exports transported by mode. FAF simplifies foreign origins or destinations into eight categories: Canada, Mexico, Rest of Americas, Europe, Africa, Southwest and Central Asia, Eastern Asia, and Southeast Asia and Oceania. Similarly, there are eight modes of transportation, truck, rail, water, air, multiple modes and mail, pipeline, other and unknown, and no domestic mode. FAF presents mode of transportation in two forms, one that categorizes the domestic mode of transportation of imports or exports and one that is the foreign mode of transportation for imports or exports. The domestic mode of transportation is the mode freight uses after it has entered the United States from abroad or will be exported after it has traveled to a port. The foreign mode is the mode freight uses when it is traveling to the United States from a foreign country or after it has left the United States destined for a foreign country. Also, the data presented are from 2007, because the data that underlie FAF were collected in 2007.

Imports

Table 9 provides the country/regional distribution of imports by value and tonnage to begin the modal distribution discussion. Table 9 adds to the USA Trade Online data by adding the tonnage of the imports into the MAFC. The total trade by value is consistent with the USA Trade Online dataset in that it is slightly less than the imported value in 2008 and the relative size of country such as Canada and Mexico are consistent. The transition from value to tonnage of imports significantly affects the geographic distribution of imports. A couple countries/regions have modest increases, but Canada more than doubles its influence. The country/regional distribution of flows is important to understanding which countries are driving the modal distribution of freight. We would expect the modal distribution of goods measured by tonnage to reflect Canada’s distribution much closer than if measured by value.

Table 9: 2007 MAFC Import Partners by Value and Tonnage

| Country/Region | Value ($ millions) | Percent of Total | Tons (‘000) | Percent of Total |

| Canada | $128,574 | 31.9% | 145,299 | 65.6% |

| Mexico | $50,908 | 12.6% | 12,088 | 5.5% |

| Rest of Americas | $13,745 | 3.4% | 11,860 | 5.4% |

| Europe | $56,942 | 14.1% | 12,288 | 5.6% |

| Africa | $4,776 | 1.2% | 5,739 | 2.6% |

| Southwest and Central Asia | $13,618 | 3.4% | 11,809 | 5.3% |

| Eastern Asia | $122,911 | 30.5% | 19,466 | 8.8% |

| Southeast Asia and Oceania | $10,980 | 2.7% | 2,831 | 1.3% |

| Totals | $402,454 | 100.0% | 221,380 | 100.0% |

Source: Freight Analysis Framework 3.4, 2013

Table 10 displays the domestic mode of transportation that imports use once they have reached the US. Trucking dominates imports based on value and is supported by Rail and multiple modes transporting a combined 30 percent, while the other modes transport less than 10 percent each. Conversely, tonnage favors pipelines with increases its share of the total by 4.75 times compared to value. Canada dominates pipeline flows with 84 percent of the total. Rail also increased from 15 to 19 percent and trucking fell substantially from 53 to 34 percent.

Table 10: Domestic Mode for Imports into the MAFC 2007

| Mode | Value ($ millions) | Percent of Total | Tons (‘000) | Percent of Total |

| Truck | $214,643 | 53% | 74,559 | 34% |

| Rail | $59,073 | 15% | 43,081 | 19% |

| Water | $597 | 0% | 2,365 | 1% |

| Multiple modes & mail | $61,026 | 15% | 14,060 | 6% |

| Other and unknown | $6,165 | 2% | 2,493 | 1% |

| Pipeline | $32,820 | 8% | 84,463 | 38% |

| Air (include truck-air) | $28,130 | 7% | 359 | 0% |

| Total | $402,454 | 100% | 221,380 | 100% |

Source: Freight Analysis Framework 3.4, 2013

Table 11 shows the mode that imports used to arrive in the United States and as such, the modal distribution changed substantially compared to the domestic mode of transportation. The role of trucking dropped roughly in half for value and more than double in tonnage. Canada accounts for 68.9 percent of the value and 81.0 percent of the tonnage transported to the United States destined for the MAFC by truck. Eastern Asia is the major driver of the increase in water and rail traffic, contributing 56.3 and 52.4 percent of the total value respectively. Canada is the only country to transport freight via pipeline to the MAFC.

Table 11: Foreign Mode

| Mode | Value | Percent of Total | Tons (‘000) | Percent of Total |

| Truck | $92,236 | 23% | 29,889 | 14% |

| Rail | $52,889 | 13% | 38,551 | 17% |

| Water | $147,384 | 37% | 79,243 | 36% |

| Multiple modes & mail | $7,891 | 2% | 1,339 | 1% |

| Other and unknown | $3,026 | 1% | 763 | 0% |

| Pipeline | $26,762 | 7% | 70,675 | 32% |

| Air (include truck-air) | $72,265 | 18% | 919 | 0% |

| Total | $402,454 | 100% | 221,380 | 100% |

Source: Freight Analysis Framework 3.4, 2013

The appendix to this section includes tables that break down modal distribution by mode and country for value and tonnage.

Exports

We conduct the MAFC export analysis in the same fashion as imports. First, we display the global distribution of export flows and then we display both the domestic and foreign mode of transportation for MAFC exports. The export section provides the user to compare and contrast similarities between imports and exports modal distribution within and outside the United States.

Table 12 displays the aggregated export flows by value and tonnage at FAF’s country/region level. Also, each country’s percent of total is presented to display its relative importance to the MAFC as an export partner. Canada’s importance relative to imports has increased in value, but decreased in terms of tons. Whereas the opposite is true for Eastern Asia, which decreased in value terms and increased in tonnage terms. Europe increased its importance relative to imports on both value and tonnage measures.

Table 12: 2007 MAFC Export Partners by Value and Tonnage

| Country/Region | Value ($ millions) | Percent of Total | Tons (‘000) | Percent of Total |

| Canada | $103,954 | 40% | 63,348 | 35% |

| Mexico | $23,308 | 9% | 17,283 | 10% |

| Rest of Americas | $18,169 | 7% | 13,689 | 8% |

| Europe | $48,542 | 19% | 16,574 | 9% |

| Africa | $5,085 | 2% | 13,385 | 7% |

| SW & Central Asia | $9,220 | 4% | 11,460 | 6% |

| Eastern Asia | $39,457 | 15% | 40,832 | 23% |

| SE Asia & Oceania | $9,212 | 4% | 4,770 | 3% |

| Totals | $256,947 | 100% | 181,342 | 100% |

Source: Freight Analysis Framework 3.4, 2013

Table 13 displays the value and tonnage of each mode and the overall percentage of the total for each mode. The MAFC transports the majority of exports domestically by truck. The increase in reliance on truck is almost entirely due to Canada comprising a larger percentage of trade by value. In conjunction with Canada comprising a higher portion of total trade, 77 percent of all Canadian exports move by truck domestically. The changes in modal distribution when measuring exports by tonnage or value are attributable to both shifts in the distribution of exports attributable to each country and shifts in the modal distribution for each country when measuring by tonnage or value. For instance, the Rest of Americas category ships 60 percent on truck, 9 percent on rail, 6 percent on water, 23 percent on multiple modes, and 1 percent on other when exports are measured by value. Conversely when exports are measured by tons the Rest of Americas ship 17 percent on truck, 22 percent on rail, 44 percent on water, 14 percent on multiple modes, and 3 percent on other.

Table 13: Domestic Mode for Exports into the MAFC 2007

| Mode | Value | Percent of Total | Tons | Percent of Total |

| Truck | $162,135 | 63% | 60,504 | 33% |

| Rail | $37,159 | 14% | 50,241 | 28% |

| Water | $6,315 | 2% | 36,058 | 20% |

| Multiple modes & mail | $25,012 | 10% | 21,541 | 12% |

| Other and unknown | $8,246 | 3% | 11,136 | 6% |

| Pipeline | $2,266 | 1% | 1,631 | 1% |

| Air (include truck-air) | $15,814 | 6% | 231 | 0% |

| Total | $256,947 | 100% | 181,342 | 100% |

Source: Freight Analysis Framework 3.4, 2013

The use of maritime transport to reach markets in the Americas minus Canada and Mexico, Eastern Asia, Southwest and Central Asia, and Europe really drives the increase in water transportation. Trucking is still the largest transporter of freight for Canada and Mexico by value, which enables trucking to maintain the top spot by value.

Tonnage is a very different story. Between 95-100 percent of tonnage exported to the Americas minus Canada and Mexico, Africa, Eastern Asia, Southeast Asia and Oceania, and Southwest and Central Asia. Additionally, the largest transporter of goods to Mexico is rail from trucking. Canada’s mode of transportation is still dominated by trucking, but decreased from 75 to 40 percent of the freight.

Table 14: Foreign Mode for Exports into the MAFC 2007

| Mode | Value | Percent of Total | Tons | Percent of Total |

| Truck | $91,526 | 36% | 29,956 | 17% |

| Rail | $19,949 | 8% | 22,026 | 12% |

| Water | $77,725 | 30% | 119,373 | 66% |

| Multiple modes & mail | $7,303 | 3% | 4,534 | 3% |

| Other and unknown | $6,513 | 3% | 3,135 | 2% |

| Pipeline | $2,263 | 1% | 1,605 | 1% |

| Air (include truck-air) | $51,666 | 20% | 713 | 0% |

| Total | $256,947 | 100% | 181,342 | 100% |

Source: Freight Analysis Framework 3.4, 2013